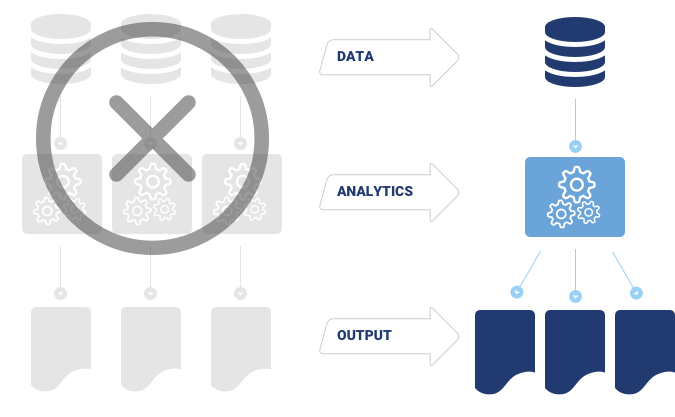

- Streamline your deposit analytics process Your entire deposit analytics process – data, analytics and output – can be streamlined and integrated, and leveraged into your existing (usually ALM) models and processes

- Lower your costs Data and modeling resources can be shared by departments and business units to lower cost and cut processing time.

- Enhance business processes More accurate and real-time risk measurement and monitoring can now be applied to enhance business processes and inform decision-making throughout the bank.

Deposit Data Advisory

DDA (Deposit Data Analytics) provides a growing suite of deposit applications and services that will significantly improve the quality and extend the application of your analytics.

DDA Analytics are the first meaningful improvement in

deposit analytics and methodologies in over a decade.

We think you’ll agree, DDA Analytics are:

BETTER

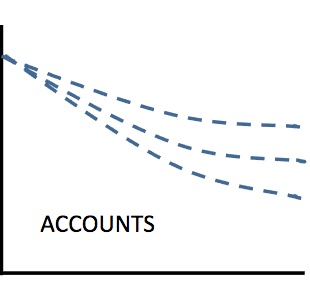

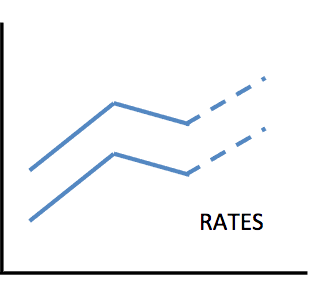

Data drives analytics, and more and better data

enables more granular and more precise measurement.

FASTER

We configure all of your data history into a SQL database. We manage maintenance

and updates automatically. You just login and initiate re-calculation and download of

pre-formatted attrition factors and rate simulations

…anytime…anywhere…any device.

CHEAPER

No more data/IT projects.

No more RFPs and stale “deposit studies”.

No more annual budget and contract cycles.

“It’s not rocket science; it’s common sense.”

DDA’s “Streamline” Approach

- Integrates & improves analytics

- Serves multiple applications

- Eliminates costly repetition and duplication

Working with MIAC - Jointly Offering Deposit Analytics

“MIAC is proud to be associated with ALCO Partners, a preeminent firm engaged in deposit analytics, ALM consulting and model validation work, to jointly offer deposit analytics through the MIAC Asset Forum.” miacanalytics.com

DDA is a joint undertaking of ALCO Partners and The Mortgage Industry Advisory Corporation - "MIAC"