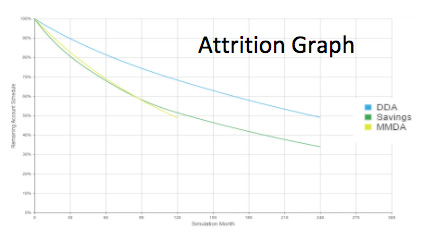

With DDA’s Attrition Analytics you can break the costly and time-consuming cycle of low-value, repetitive and expensive “deposit studies”

Deposit Account Attrition Analytics

Q: What’s wrong with Attrition Analytics?

A: Just about everything.

In most cases Attrition Analytics are:

- Seldom applied to real-world risk

- Repetitive, time-consuming and expensive

- Stale-dated the day they are delivered

Whether you work with accounts or balances, DDA’s Attrition Analytics will improve your metrics, save you a boatload of time, and cost you way less than anything else available.

You get:

- Best-in-class analytics (vintage analysis and mortality tables)

- Based on your entire available account and balance history

- Updated to reflect the changing age and composition of your depositor base

- Output formatted for your existing ALM model

- Optional monitoring against history, with customized alerts

And guess what?

“NO MORE IT/DATA PROJECTS”

- You give us all history you have – any amount, any format

- We clean it up and store it in a secure SQL database

- We configure and run automatic database updates